Conférence & Séminaire

Seminar with Deloitte - New Tax Regulations and Their Impact on Business & Networking with Confindustria Bulgaria & BBBA

L'événement est terminé.

What do we have to know?

| |||||

| |||||

|

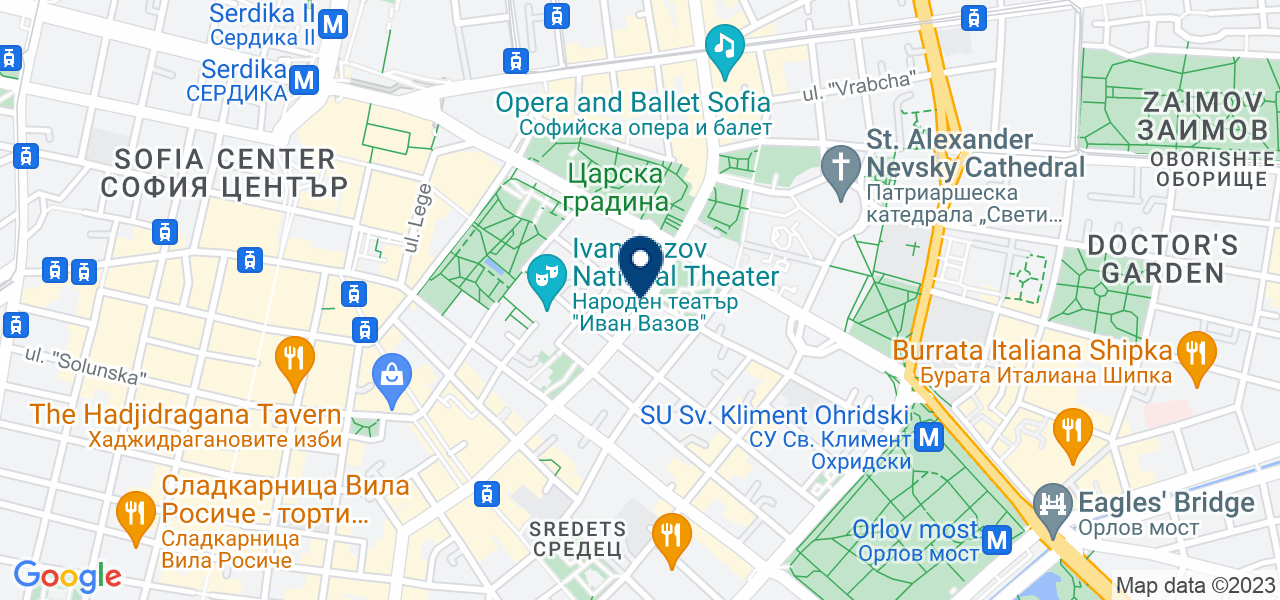

Modalités d'accès

Seminar with Deloitte - New Tax Regulations and Their Impact on Business & Networking with Confindustria Bulgaria & BBBA

L'événement est terminé.